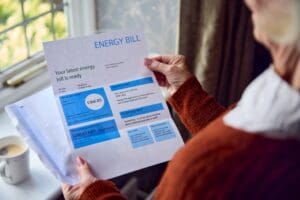

UK inflation climbed to a six-month high in October, surpassing the Bank of England’s 2% target, driven primarily by increased household energy bills.

The Office for National Statistics (ONS) reported that the annual Consumer Price Index (CPI) rose to 2.3% last month, up from 1.7% in September—the highest rate since April. This figure exceeded both economists’ forecasts of 2.2% and the Bank of England’s projection of 2.1%.

The rise was widely anticipated following Ofgem’s decision to increase the energy price cap in October. The ONS noted that housing costs, reflecting higher gas and electricity prices, were the largest contributors to the inflation uptick. There were also smaller increases in transport, furniture costs, and restaurant prices. Conversely, the recreation and leisure sector saw declining inflation, making its smallest contribution to the price basket in two years.

Grant Fitzner, chief economist at the ONS, said: “Inflation rose this month as the increase in the energy price cap meant higher costs for gas and electricity compared with a fall at the same time last year. These were partially offset by falls in recreation and culture, including live music and theatre ticket prices.

“The cost of raw materials for businesses continued to fall, once again driven by lower crude oil prices.”

Key sub-components of inflation also saw increases. The services sector inflation, closely watched by the Bank of England, strengthened from 4.9% to 5%, aligning with the Bank’s forecasts. Core inflation, which excludes volatile food and energy prices, edged up from 3.2% to 3.3%, defying expectations of a drop to 3.1%.

Andrew Bailey, Governor of the Bank of England, warned that inflation in the services sector remains “incompatible” with the Bank’s 2% target over the medium term. Despite cutting interest rates for the second time this year to 4.75%, policymakers are divided on the future path of inflation. Four of the nine members of the Monetary Policy Committee expressed differing views during a parliamentary hearing on Tuesday.

Official figures due tomorrow are expected to show an uptick in the Consumer Price Index to 2.1% in October, driven by rising household energy bills. Traders currently do not anticipate another interest rate cut this year, with expectations of a maximum of four cuts in 2025, potentially lowering the base rate to 3.75%.

The UK’s 2.3% inflation rate in October compares with an average of 2% in the eurozone and 2.6% in the United States.

Read more:

UK inflation rises to 2.3% in October on higher energy costs